Consumers Want Faster Delivery and They’re Willing to Pay for It

We’re announcing results of our annual consumer survey, which aims to uncover shoppers’ motivations and expectations surrounding delivery. The findings from the survey surfaced a startling insight that should be on every retailer’s radar: consumer expectations around delivery are rapidly increasing, yet their delivery experiences are declining. Simultaneously, trust in crowdsourced, peer-to-peer delivery services, as well as traditional delivery providers are also faltering. In 2018, only 14% of consumers trust peer-to-peer delivery services.

An astonishing 99% of U.S. consumers say ‘fast delivery’ is important to them when making online purchases. At the same time, more consumers feel frustrated with the lack of professionalism and accuracy (deliveries arriving late, damaged, etc.) when having items delivered. This tells us that retailers are struggling to keep up with the increasing demand for faster delivery. And while this may seem daunting, it’s a positive for retailers looking to exceed expectations. There’s plenty of opportunity to capture consumer loyalty when delivery is done right.

This leads to the question: how is delivery done right? To begin, let’s take a look at what consumers really want, where retailers are currently falling short, and what solutions can help businesses overcome common delivery challenges to win big.

What Consumers Want

Faster delivery

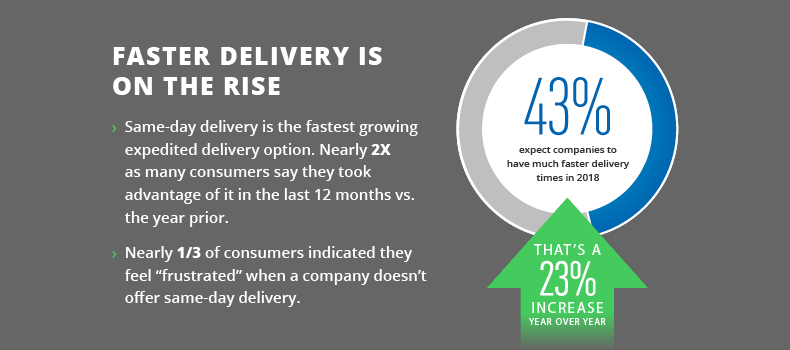

The survey revealed 43% of U.S. consumers expect companies to have ‘much faster’ delivery times than the previous year. That’s up from 35% in 2017. For businesses without a streamlined delivery service in place, this poses an important question: how can you meet the rising expectations of your customers without falling short on the quality of your overall experiences?

Same-day delivery

According to our survey, same-day delivery was the fastest growing expedited delivery option in the past year. Whereas only 17% of consumers stated they took advantage of same-day delivery in 2017, 31% of consumers say they opted for it in 2018. To make matters more urgent for retailers, nearly a third of consumers now say they feel ‘frustrated’ when a company doesn’t offer same-day delivery.

On the other hand, retailers that do offer same-day delivery have the opportunity to increase customer loyalty. 74% of consumers say they’re more likely to purchase again from a company after receiving same-day delivery on an item.

Professionalism

75% of consumers agree that the professionalism of the delivery person is important. Ultimately, the professionalism of the delivery provider directly reflects on the retailer. Receiving a package is often the last step of a consumers’ purchase experience, and therefore has the ability to leave the strongest impression—good or bad.

Real-time tracking

According to the survey, consumers want to be kept “in the know” regarding what stage of the delivery process their purchases are in, and when they can expect to receive them. 88% of consumers say the ability to track shipments in real-time is important.

Find more stats around consumer expectations in Dropoff’s new ebook!

What Consumers Experience

Consumers want faster delivery options with real-time tracking and good customer service. The findings from our survey show that there’s a huge discrepancy between how quickly consumers want items versus how quickly they’re receiving them. Refer to the ebook for more information about specific products—like clothing, appliances, and health care-related items—consumers would like to receive faster, but aren’t.

Additionally, consumers are experiencing a decline in the quality of service provided by carriers. 78% of consumers say they’ve experienced packages arriving late (up from 70% in 2017), and 56% of consumers received damaged packages (up from 42% in 2017). This decline is also consistent for those who received incorrect or damaged items, or experienced their packages going missing altogether.

The Expectations Gap

There is currently a large gap in experiences between what product categories consumers want to be delivered same-day and what products they actually receive same-day. This presents a huge opportunity for retailers to fill that need.

- Groceries: 64% want same-day, 19% receive same-day

- Health Care Products: 46% want same-day, 4% receive same-day

- Specialty Snacks: 42% want same-day, 7% receive same-day

- Alcohol: 41% want same-day, 5% receive same-day

- Household Products: 28% want same-day, 5% receive same-day

- + more

Delivery Options Affect Purchasing Decisions

Consumers will pay for fast delivery

More and more consumers want faster delivery, and they’re willing to pay for it. In fact, 47% of U.S. consumers say they’ve paid extra for either same-day or next day delivery. Whether a retailer offers faster delivery options for free or charge for it, it’s paramount that it’s an option in the first place. Without it, retailers risk losing out on the 53% of consumers who’ve abandoned an online purchase because of slow delivery times.

Quality matters

Consumers are experiencing a decline in quality and professionalism when receiving packages, from late deliveries to damaged packages and products. According to the survey, 75% of consumers want a more professional delivery service—and their desire is increasing. In 2017, 72% of consumers said that the professionalism of a delivery person was important to them.

When retailers don’t meet this expectation, consumers are less likely to stay loyal. 57% of consumers say that once they’ve experienced unprofessionalism from a delivery person, they’re less likely to purchase from that retailer again.

Who’s delivering your product?

Only 12% of U.S. consumers say they prefer to have packages delivered by the merchant from which they purchased, meaning consumers are open to receiving packages from third-party delivery services. Consumers are not, however, feeling good about crowdsourced, peer-to-peer delivery. Trust in it is very low (only 14%) and not increasing year-over-year. Professionalism is important to consumers, so retailers must be mindful of the third-party delivery providers they partner with when outsourcing solutions for delivering their product.

Stand-Out Consumer Segments

Millennials

The expectation for speed is growing faster for millennials than non-millennials, though both are on the rise. In 2018, 50% of millennials expect faster delivery compared to a year ago, whereas only 41% of millennials expressed those increasing year-over-year expectations in 2017.

Based on that information, it’s unsurprising that more millennials have actually paid extra for faster delivery in the past year (54% of millennials reported paying extra for faster delivery in the past 12 months compared to 39% of non-millennials).

Luxury shoppers

Luxury shoppers expect more from their delivery experiences than non-luxury shoppers. They’re 32% more likely to expect ‘much faster’ delivery times from companies compared to a year ago, and are 80% more likely to feel frustrated when same-day delivery isn’t an option.

And like millennials, they’ll pay for it. Luxury shoppers are 110% more likely to have paid extra for same-day delivery in the past 12 months.

Amazon shoppers

Retailers can breathe a sigh of relief. Dropoff’s survey shows that Amazon shoppers aren’t committed to purchasing solely from the online retail giant. 65% of consumers who shop at Amazon say they would order from other retailers that offer the same delivery options.

Early tech adopters

Early tech adopters, including those that purchase items for delivery using smart watches and digital assistants, want everything faster. They’re also more likely to abandon an online purchase if the delivery options aren’t fast enough (60% of early tech adopters versus 51% non-early tech adopters).

And as we’ve seen consistently, the more likely a consumer wants fast delivery, the more likely they are to pay for it. Early tech adopters are more than twice as likely to have paid extra for same-day delivery in the past 12 months (27% versus 11%).

Check out Dropoff’s new ebook to learn more about what drives these consumer segments.

Delivery Solutions for Retailers

Clearly, delivery options and quality play a major role in consumers’ purchase decisions. When done right, retailers stand to gain a lot, from attracting new customers to encouraging loyalty. But getting delivery right isn’t easy. It requires the ability to send deliveries out quickly in a professional manner without compromising quality.

Dropoff helps businesses meet (and exceed) delivery expectations by providing the kind of service that represents retailers in the best light possible. With features like real-time tracking (for both businesses and their customers), flexible delivery options, and assured professionalism, Dropoff gives businesses the peace of mind that their product and customers are in good hands.

Discover more stats regarding consumer delivery preferences and shopping habits in Dropoff’s new ebook.

Survey Methodology

The findings presented here are the result of a February 2018 study of 995 U.S. consumers who answered “Yes” to the initial question, “Do you ever purchase products or items that need to be delivered?”